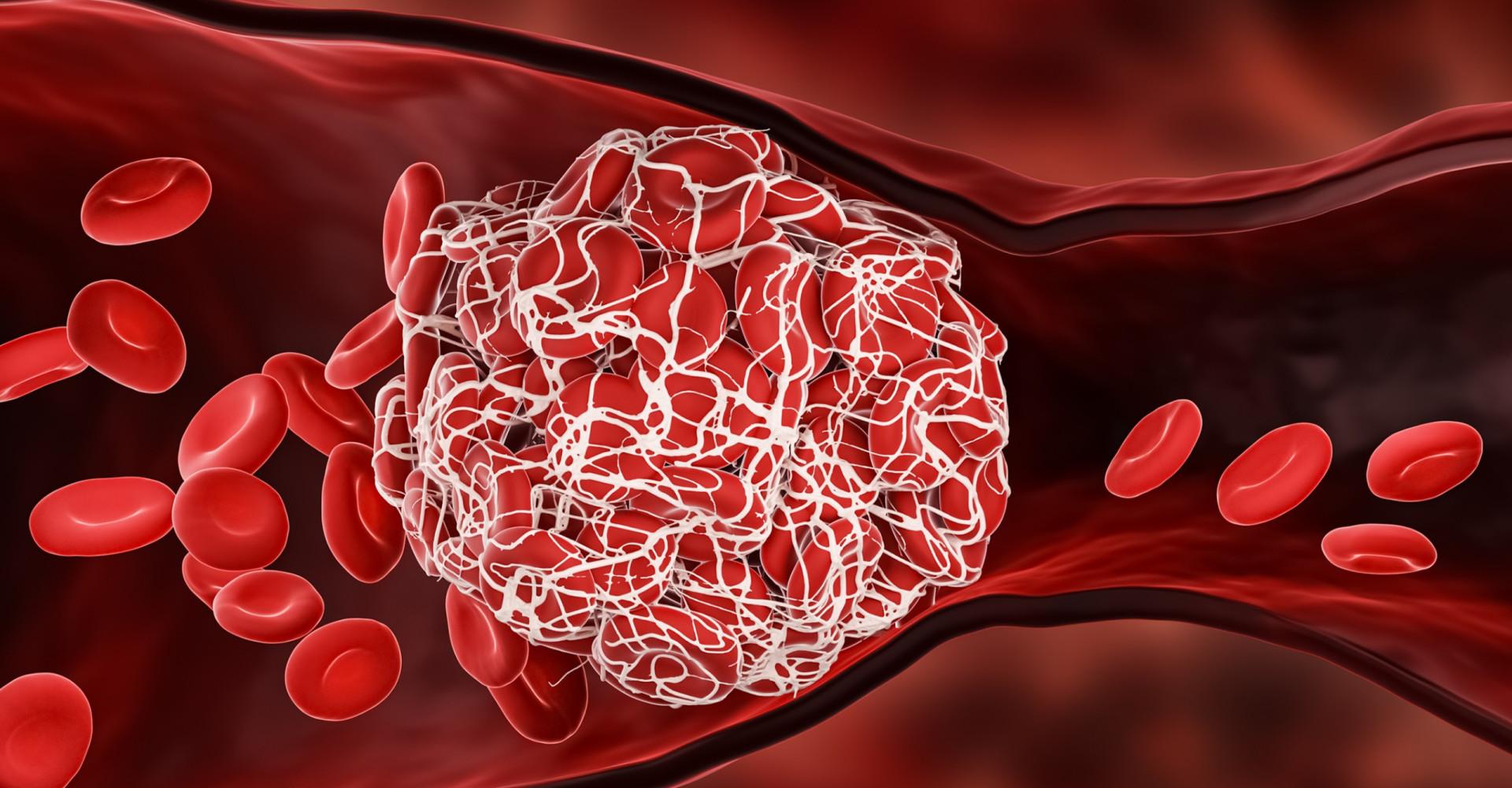

The global clot busting drugs market size is projected to increase at a compound annual growth rate (CAGR) of 7.3% to reach US$ 58.4 billion by the end of 2032, from an estimated US$ 28.8 billion in 2022. The injectable mode of administration is leading the global market for clot-busting medications as of 2021.

Due to the quick development of clot-busting medication's molecular and biological customisation as well as the rising incidence of cardiovascular illnesses and aging population globally, the market for these medications is growing quickly on a global scale. The market for clot-busting medications is anticipated to develop significantly over the projected years as a result of the rising demand for these medications in the prevention of heart attacks and strokes.

Due to side effects and lack of knowledge, clot busting treatments are not meeting consumer demand, hence businesses are coming out with new, reasonably priced clot busting drugs with less adverse effects. It is anticipated that this will greatly increase the uptake and intake of medications that break blood clots. The rising product launches and approvals are expected to further contribute to the market growth over the forecast period.

Get a Sample Copy of the Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-15689

Key Takeaways from Market Study

- Anticoagulants are the leading segment as a product, and hold approximately 36.7% market share in 2021, due to the rise in chronic diseases, the development of anticoagulant medicines has become more molecularly and biologically advanced, and emerging nations are increasingly using novel oral anticoagulants.

- Pulmonary Embolism are the leading segment by indication, and held about 31.2% market share in 2021, owing to the increasing number of cancer patients and patients who have a family history of cardiovascular issues.

- Injectable category is the leading segment in route of administration of drugs by holding more than half of the global market share owed to growing need for tools like safety syringes, prefilled syringes, and auto-injectors for the prevention of needle stick injuries.

- Hospital Pharmacy is the leading distribution channel as of 2021, withholding about one third of the global market share by value due to wide range of product availability, convenience and patients’ reliance on hospitals for treatments.

- By region, North America is leading in the global clot busting drugs market with 32.4% of the revenue share on 2021 and is expected to continue to do so with a projected CAGR rate of 8.0% during the forecasted years.

“Rising initiatives to promote health benefits of clot busting drugs, as well as the increasing awareness about the prevention of heart attacks and strokes is set to propel the sales of clot busting drugs devices across the globe,” says an analyst of Future Market Insights.

Market Competition

The market for clot busting drugs is quite competitive due to the presence of numerous local or regional players. The companies are concentrating on implementing different business strategies, such as product launches, drug development, and geographic expansions. For Instance:

- In Dec 2021, Janssen Pharmaceutical received U.S. FDA approval for its oral anticoagulant called XARELTO (rivaroxaban). The drug was approved for 2 indications for pediatric category which includes prophylaxis of DVT or deep vein thrombosis resulting in pulmonary embolism.

- AstraZeneca’s Brilinta (ticagrelor) received FDA approval for its P2Y12 receptor antagonist, an oral, reversible drug that prevents platelet activation, in June 2020 to lower the risk of a stroke or a first heart attack in patients with high-risk of coronary artery disease (CAD).

Key Segments Covered in Clot Busting Drugs Industry Research

By Product:

- Thrombolytic Drugs

- Anti-Platelet Drugs

- Anticoagulants

- Others

By Indication:

- Pulmonary Embolism

- Deep Vein Thrombosis

- Atrial Fibrillation

- Others

By Route of Administration:

- Oral

- Injectable

By Distribution Channel:

- Hospital Pharmacy

- Drug Store

- Online Pharmacy

- Retail Pharmacy

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- Middle-East and Africa (MEA)