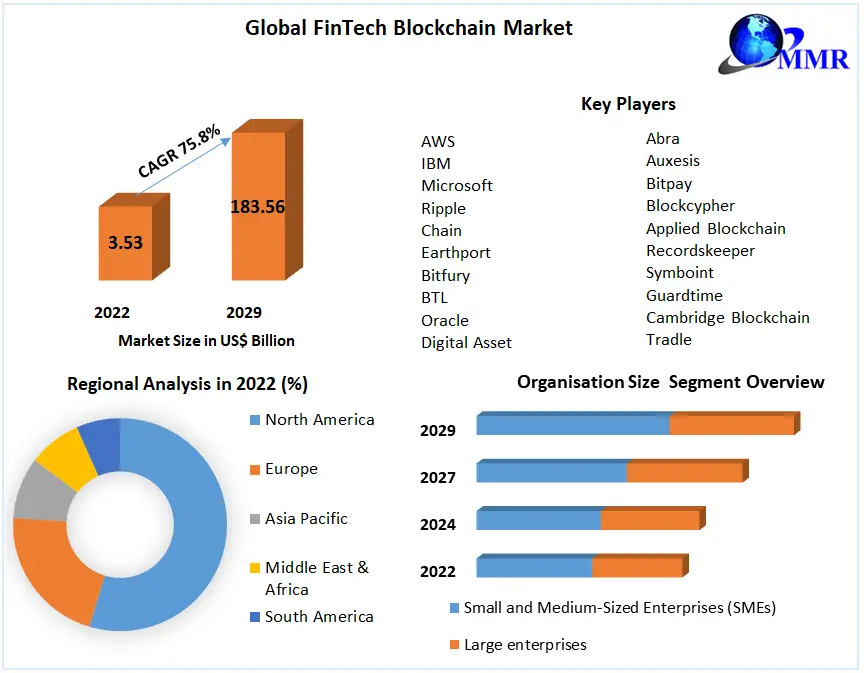

FinTech Blockchain Market size was valued at US$ 3.53 Bn. in 2022 and the total FinTech Blockchain revenue is expected to grow by 75.80% from 2023 to 2029, reaching nearly US$ 183.56 Bn.

FinTech Blockchain Market Overview:

The competitive landscape of the FinTech Blockchain market includes information about competitors. Among the areas covered are a firm overview, financials, revenue generated, market potential, R&D investment, new market efforts, geographical presence, business strengths and weaknesses, product introduction, and application dominance. The information that follows is only relevant to the organization's concentration on the FinTech Blockchain market.

Request for free sample@https://www.maximizemarketresearch.com/request-sample/13770

Market Scope:

Top-down and bottom-up approaches are used to validate the market size and estimate the market size by different segments. The market estimations in the research are based on the sale price (excluding any discounts provided by the manufacturer, distributor, wholesaler, or traders). Weights based on usage rate and average sale price are applied to each area to generate percentage splits, market shares, and segment breakdowns. The country-wise divisions of the overall market and its sub-segments are determined by the percentage adoption or usage of the specified market Size in the relevant area or nation.

Segmentation:

by Organization

SMEs are anticipated to expand at a CAGR of 8.9% over the course of the projection period in terms of Organisation Size. Small firms use fintech to outsource complexity and expertise because they have less time, money, and human resources to spend to creating their own specialised tech solutions. For SMEs, APIs and other low-code, plug-and-play solutions in general are very helpful since they let them launch digital solutions as quickly as possible, with no upfront costs and no disruption to operations.

1 Global FinTech blockchain Market, by Application (2022-2029)

• Payments, clearing, and settlement

• Exchanges and remittance

• Smart contracts

• Identity management

• Compliance management/Know Your Customer (KYC)

• Others (cyber liability and content storage management

2 Global FinTech blockchain Market, by Provider (2022-2029)

• Application and solution providers

• Middleware providers

• Infrastructure and protocols providers

3 Global FinTech blockchain Market, by Organization Size (2022-2029)

• Small and Medium-Sized Enterprises (SMEs)

• Large enterprises

4 Global FinTech blockchain Market, by Industry Vertical (2022-2029)

• Banking

• Non-banking financial services

• Insurance

Key Players: Primary and secondary research are used to identify market leaders, and primary and secondary research are used to calculate market revenue. In-depth interviews with important thought leaders and industry professionals such as experienced front-line staff, CEOs, and marketing executives were conducted as part of the primary study. Primary research comprised in-depth interviews with key thought leaders and industry professionals such as experienced front-line staff, CEOs, and marketing executives, while secondary research included a review of the main manufacturers' annual and financial reports. Secondary data is used to determine percentage splits, market shares, growth rates, and worldwide market breakdowns, which are then cross-checked with primary data.

The following are the key players of the FinTech Blockchain market-

1. AWS

2. IBM

3.Microsoft

3. Ripple

4. Chain

5. Earthport

6. Bitfury

7. BTL

8. Oracle

9. Digital Asset

10. Circle

11. Factom

12. Alphapoint

13. Coinbase

14. Abra

15. Auxesis

16. Bitpay

17. Blockcypher

18. Applied Blockchain

19. Recordskeeper

20. Symboint

21. Guardtime

22. Cambridge Blockchain

23. Tradle

24. Robinhood

25. Veem

26. Stellar

Request for free sample@https://www.maximizemarketresearch.com/request-sample/13770

Regional Analysis:

Individual market influencing components and changes in market rules that impact present and future market trends are also explored in the research's geographical component. Downstream and upstream value chain analysis, technology trends, Porter's five forces analysis, and case studies are some of the elements utilized to anticipate market scenarios for various nations.

COVID-19 Impact Analysis on FinTech Blockchain Market: In addition, the paper evaluates the influence of COVID-19 on the FinTech Blockchain market. The primary goal of this research is to assist users in understanding the market in terms of definition, segmentation, market potential, important trends, and challenges that the industry faces across major regions. The study presents a microeconomic and macroeconomic analysis of COVID-19's overall impact on the FinTech Blockchain Market. The analysis focuses on market share and size, clearly illustrating the impact of the pandemic on the global FinTech Blockchain Market in the next years.

Key Questions Answered in the FinTech Blockchain Market Report are:

- What will be the FinTech Blockchain market's CAGR throughout the projected period (2021-2027)?

- Which market category emerged as the market leader in the FinTech Blockchain industry?

- Who are the key players in the FinTech Blockchain market?

- What important trends in the FinTech Blockchain industry are anticipated to develop throughout the forecast period?

- How big will the FinTech Blockchain market be in 2027?

- In 2020, which business segment had the highest proportion of the FinTech Blockchain market?