Keeping track of shared expenses can be difficult and time-consuming, particularly for people or organizations who divide bills and costs regularly. Thankfully, shared spending trackers have become a handy way to streamline and simplify the process as a result of technological advancements. With the help of these digital solutions, users can effectively monitor and control shared spending, guaranteeing ease of use, accuracy, and transparency in financial management. This post discusses the many advantages of using a shared spending tracker and explains how it may completely change how people manage their money, both individually and in groups.

Enhanced Transparency and Accountability

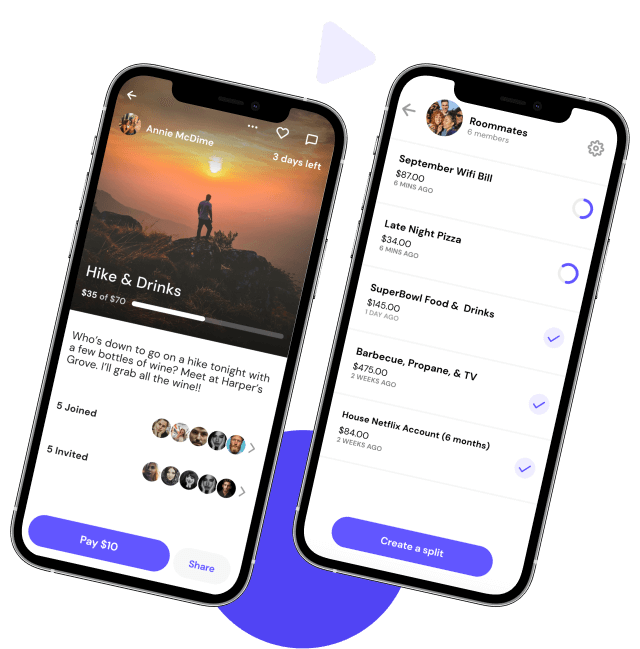

When it comes to money management, a shared spending tracker provides increased accountability and transparency. People may simply track and record their spending by using a shared platform, like a mobile app or internet tool, which guarantees that all shared expenses are accurately documented. The ability for all parties to access and examine the spending information fosters confidence amongst those who share expenses. Additionally, it promotes responsibility because there is less opportunity for misunderstandings or disagreements. After all, each person's expenses are explicitly assigned. People can maintain a clearer financial picture and forge stronger financial connections with increased accountability and openness.

Convenient Expense Tracking and Splitting

Splitting and tracking spending is made easier with shared expense trackers. People may easily and quickly input their spending and categorize it for a better organization with a shared platform. Sharing expenses is made easier by the expense tracker, which computes each person's portion automatically. This ease of use reduces the possibility of error and does away with the requirement for laborious computations. Furthermore, options for linking credit card and bank data are frequently offered by shared expense trackers, enabling smooth transaction tracking. People may ensure that all expenses are appropriately documented and divided while also saving time and effort by streamlining the process of tracking and sharing expenses.

Efficient Reporting and Analysis

With the use of shared cost trackers, users can obtain insightful knowledge about their spending patterns and financial habits through effective reporting and analysis features. These tools produce thorough reports and summaries that give a thorough picture of spending over a certain time frame. To help people find areas where they may make changes to enhance their financial health, the reports can be tailored to examine spending by category, date, or individual. People who have access to this information can create more efficient saving plans and make well-informed financial decisions. Shared spending trackers' effective reporting and analysis tools enable people to take charge of their money and make progress toward their financial objectives.

Convenience and Accessibility

Because users may see their spending information from anywhere at any time, shared expense trackers are convenient and accessible. The majority of platforms for sharing expenses feature web interfaces or mobile apps that make it simple to view and update spending while on the road. This gets rid of the need to keep paper receipts or rely on recollection to later record spending. Furthermore, users have the option to allow other users—roommates, partners, or friends—to access their accounts, guaranteeing that all shared spending is precisely recorded by all parties. For people with varied lifestyles and hectic schedules, shared spending trackers are a useful tool because of their accessibility and ease of use.

Conclusion

The sometimes difficult process of monitoring and controlling shared financial activities is made easier with a shared spending tracker. Shared expenditure trackers transform how people and organizations manage their finances with improved transparency, easy recording and splitting of expenses, effective reporting and analysis, and ease of accessibility. Individuals and groups can simplify their lives, encourage accountability and openness, and expedite their financial management procedures by implementing a shared spending tracker. Grab the advantages of a shared expenditure tracker to streamline your finances and experience more control and transparency over your money. Bid adieu to convoluted spreadsheets and uncertainty around shared expenses.

Click https://www.mosea.io/en-ca/uses/group-expense-app for more details.