Market Overview

The leading global market research organization has recently released its latest market research report focusing on the Decentralized Finance market. This all-inclusive report presents comprehensive data and graphical representations, providing an analysis of both regional and global markets. Additionally, the report delves into the market's objectives, shedding light on top competitors, their market value, current trending strategies, skims, targets, and product offerings. Moreover, it highlights the recent market growth while offering valuable insights into its informative historical trends.

Market Value :

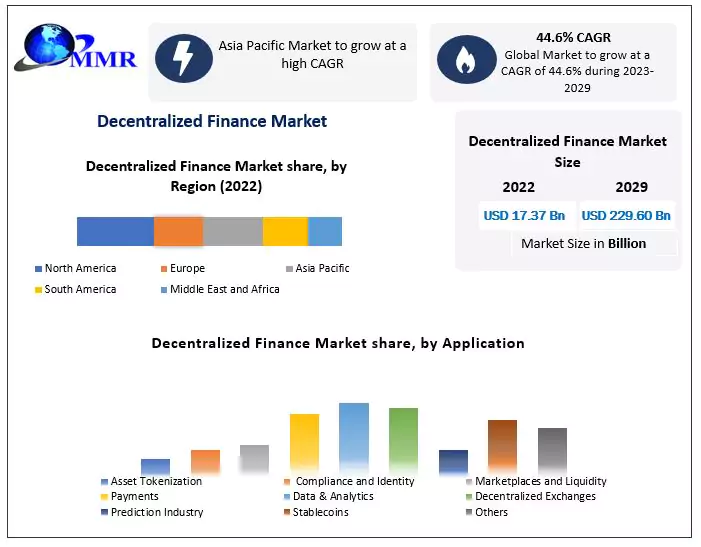

In 2022, the Decentralized Finance (DeFi) Market surged to a valuation of USD 17.37 billion, poised to experience exponential growth with an anticipated CAGR of 44.6%, projecting a market worth of USD 229.60 billion by 2029. This report delves into the intricacies of the DeFi landscape, highlighting its transformative potential in the realm of financial services.

For detail insights on this market, request for methodology here@https://www.maximizemarketresearch.com/request-sample/203718

Market Dynamics:

Drivers:

Inclusive Financial Services: DeFi caters to the unbanked and underbanked population, extending financial products and services to individuals with internet access, regardless of traditional banking access. This inclusivity boosts DeFi adoption.

Decentralized Nature: Operating on open and permissionless blockchain networks, DeFi allows anyone to create, participate, or interact with applications without intermediary approval. This resonates with individuals seeking control over their assets and financial sovereignty.

Innovation and Experimentation: The DeFi industry is a hotbed of innovation, attracting investors and technologists eager to push the boundaries of what's possible in finance. Developers and entrepreneurs continually create and launch new DeFi protocols, tokens, and applications, contributing to a vibrant ecosystem.

Institutional Interest: The growing DeFi market is drawing in institutional players like asset managers, investment funds, and corporations. Tailored DeFi products and services meeting institutional needs, such as risk management tools and compliance services, present significant opportunities.

Challenges:

Stolen or Lost Funds: The decentralized nature of DeFi makes it challenging to recover lost or stolen funds, presenting a major challenge for the market.

Regulatory and Compliance Concerns: Rapidly evolving regulatory landscapes pose challenges for DeFi projects, especially in the context of Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Price Volatility: Cryptocurrencies are known for their price volatility, introducing risks to DeFi platforms. Sudden price fluctuations can impact collateralized lending and borrowing mechanisms.

Adoption Barriers: DeFi is still finding its way beyond crypto enthusiasts and early adopters. Limited education, awareness, and a steep learning curve may deter mainstream users.

Market Scope

The research report conducts an in-depth analysis of trending competitors, their market growth, and dynamic patterns. It offers valuable insights into the regional and global market values and demands, aiding in a thorough understanding of the competitive landscape and market potential in terms of production, demand, and supply. The segmentation analysis encompasses crucial factors such as psychographic, demographic, geographic, and behavioral segmentation, which play a pivotal role in shaping marketing strategies, targeted products, offers, and customer experiences. Porter's analysis is employed to assess an organization's competitive strength and enhance profitability. Additionally, Pestle analysis is conducted to validate existing products and services in the current context. The SWOT analysis provides a comprehensive evaluation of internal and external factors that influence a company's advantages, disadvantages, strengths, and weaknesses. In conclusion, this report offers a comprehensive and informative overview of the Decentralized Finance market.

Segmentation

Based on Component: Decentralized Applications (dApps), Smart Contracts, and Blockchain Technology comprise the three segments of the market. In 2022, the Decentralized Finance market share that was largest was held by the Blockchain Technology category. Over the course of the projection period, the Decentralized Applications (dApps) segment is anticipated to rise at a high CAGR. Within the DeFi ecosystem, decentralized applications are user-facing programs that offer a range of financial services. These consist of yield farming systems, asset management tools, lending platforms, and decentralized exchanges (DEXs). Because smart contracts are an essential component of DeFi platforms and allow automated transactions, the market is anticipated to grow at a rapid rate over the course of the forecast period.

by Component

Blockchain Technology

Decentralized Applications (dApps)

Smart Contracts

by Application

Asset Tokenization

Compliance and Identity

Marketplaces and Liquidity

Payments

Data and Analytics

Decentralized Exchanges

Prediction Industry

Stablecoins

Others

Key Players

1. Compound Labs, Inc.

2. MakerDAO

3. Aave

4. Uniswap

5. SushiSwap

6. Curve Finance

7. Synthetix

8. Balancer

9. Bancor Network

10. Badger DAO

11. SingularityDao

12. Fantom

13. Tezos

14. Lido Dao

15. Internet Computer

16. Chainlink

17. Wrapped Bitcoin

18. Conflux

19. Injective

20. Frax Share

21. THORChain

22. 1inch Network

For detail insights on this market, request for methodology here@https://www.maximizemarketresearch.com/request-sample/203718

Regional Analysis

The report provides formal, functional, and vernacular regional analysis, identifying the most impactful business areas based on high demand in various regions, including Asia Pacific, North America, Latin America, the Middle East, Europe, and Africa. This analysis offers valuable insights into distinct targets, strategies, and market values for each region.

Key Questions Addressed in the Decentralized Finance Market Report:

- What defines the Decentralized Finance Market?

- What is the forecast period for the Decentralized Finance Market?

- How does the competitive scenario look in the Decentralized Finance market?

- Which region holds the largest market share in the Decentralized Finance Market?

- What opportunities are available in the Decentralized Finance Market?

- What factors influence the growth of the Decentralized Finance market?

- Who are the key players in the Decentralized Finance market?

- Which company holds the largest share in the Decentralized Finance market?

- What will be the CAGR of the Decentralized Finance market during the forecast period?

- What key trends are expected to emerge in the Decentralized Finance market in the upcoming years?

Key Offerings:

- Market Share, Size, and Forecast by Revenue|2023-2029

- Market Dynamics - Growth drivers, Restraints, Investment Opportunities, and key trends

- Market Segmentation: A detailed analysis by Decentralized Finance Market

- Landscape - Leading key players and other prominent key players.

About Maximize Market Research:

Maximize Market Research is a versatile market research and consulting company, comprising professionals from various industries. Our expertise spans medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology, communication, automotive, chemical products, general merchandise, beverages, personal care, and automated systems, among others. We provide market-validated industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656