Digital Payment Market Overview

Maximize Market Research is an Digital Payment research firm that has delivered a detailed analysis of the “Digital Payment Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape.

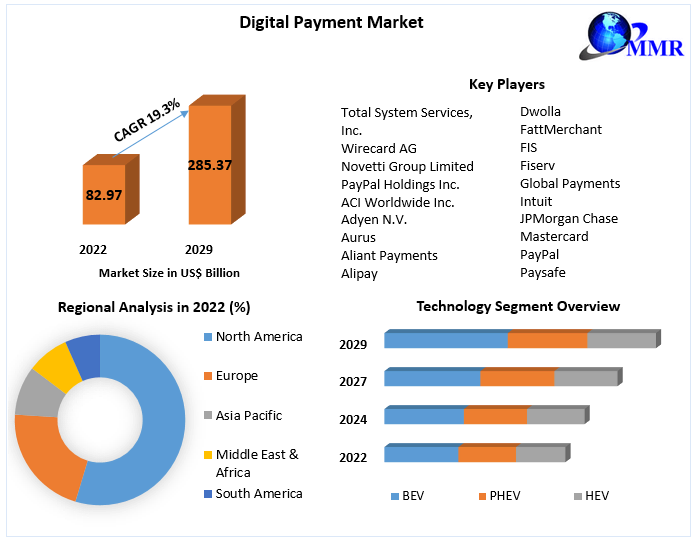

Digital Payment Market Value :

Digital Payment Market was valued at USD 82.97 Billion in 2022, and it is expected to reach USD 285.37 Billion by 2029, exhibiting a CAGR of 19.3 % during the forecast period (2023-2029)

Request Free Sample Copy (To Understand the Complete Structure of this Report [Summary + TOC]) @ : https://www.maximizemarketresearch.com/request-sample/16835

Digital Payment Market Scope and Methodology:

The report provides a comprehensive analysis of market participants in the Digital Payment market. It provides a detailed analysis of the global, regional, national, and local markets within the Digital Payment industry. The competitive analysis section highlights major industry players across various regions, offering insights into their revenue, financial standing, portfolio, and technical developments. Segment-wise analysis of the Digital Payment market is conducted based on specific criteria, examining the factors that favorably and unfavorably impact market growth. By analyzing primary and secondary data sources, the report presents forecasts for market size, growth rate, and current and future trends in the Digital Payment market. The bottom-up approach is utilized to validate the market size estimation for different segments. The report incorporates both primary and secondary data collection methods.

Qualitative and quantitative research methods are employed, utilizing tools such as SWOT analysis, PESTLE analysis, and Porter's Five Forces analysis. These analytical tools provide valuable insights into the Digital Payment market such as growth drivers and restraints. Overall, the report serves as a comprehensive guide for investors, stakeholders, and market followers of the Digital Payment market, assisting them in making informed decisions.

Digital Payment Market Regional Insights

The report includes a thorough analysis of all the factors, market size, growth rate, and import and export in regions. The Regional Analysis provides the Digital Payment market status of various countries included in the report. The Digital Payment market is broadly segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

Please connect with our representative, who will ensure you to get a report sample here @ : https://www.maximizemarketresearch.com/request-sample/16835

Digital Payment Market Segmentation

Global Digital Payment Market, by Solution (2022-2029)

• Application Program Interface

• Payment Gateway

• Payment Processing

• Payment Security & Fraud Management

• Transaction Risk Management

• Others

According to solution, the payment processing category will dominate the digital payment industry in 2022, accounting for around 25.0% of worldwide revenue. Retailers are implementing payment processing systems to give seamless checkout experiences to customers as their preference for online shopping grows around the world. Players offering payment processing solutions are strengthening their market presence through mergers and acquisitions as well as collaborations. PayU, for example, acquired Red Dot Payment, a payment solution provider, in July 2019 in order to strengthen its position in Singapore.

Global Digital Payment Market, by Mode of Payment (2022-2029)

• Bank Cards

• Digital Currencies

• Digital Wallets

• Net Banking

• Point of Sales

• Others

In terms of payment mechanism, the point-of-sale sector will dominate the digital payment market in 2022, accounting for more than 52.0% of worldwide revenue. Point of sale systems are used by retail businesses to perform transactions. The benefits of using a point of sale include quick checkout alternatives, a personalised customer experience, and several payment options. Several retailers and restaurants use the point-of-sale payment method to improve the payment experiences of their clients. For example, in January 2020, Grubhub, an online food ordering service, announced a partnership with ParTech Inc., a point-of-sale system provider, to integrate point-of-sale technologies into its food ordering process.

Global Digital Payment Market, by Deployment (2022-2029)

• Cloud

• On-premises

In terms of deployment, the on-premise segment will dominate the market in 2022, accounting for approximately 65.0% of worldwide revenue. On-premise digital payment solutions allow businesses complete control over their apps and systems, which can be easily managed by their IT team. On-premise digital payment solutions are also used by businesses to protect their apps and systems from malicious threats. In November 2019, Microsoft, for example, established a cooperation with ACI Global. The collaboration benefited ACI World Wide's on-premises customers by lowering long-term capital investment and increasing security.

Global Digital Payment Market, by Enterprise size (2022-2029)

• Large Enterprises

• Small & Medium Enterprises

In 2022, the big enterprises category led the digital payment market, accounting for more than 60.0% of worldwide revenue. Large retail establishments have a high volume of foot traffic, necessitating the adoption of digital payment systems for speedy checkouts. With digital payment systems that enable a variety of digital payment methods such as smart banking cards, point of sale, and e-wallets, customers can experience a more convenient checkout procedure. Simultaneously, businesses are attempting to provide clients with novel payment methods. For example, Klarna established a cooperation with afterpay in October 2020 to offer online clients Buy Now Pay Later services.

Global Digital Payment Market, by End-use (2022-2029)

• BFSI

• Healthcare

• IT & Telecom

• Media & Entertainment

• Retail & E-commerce

• Transportation

• Others

In terms of end-user, the BFSI sector will dominate the market in 2022, accounting for more than 23.0% of worldwide revenue. An increase in remittances to low- and middle-income countries is projected to be one of the key factors driving fresh market growth potential over the projection period. Banks are improving their skills in order to compete with digital payment solution providers such as Google, Amazon, and Facebook. Bank of America, for example, issued a digital debit card in June 2019 to make life easier for its customers.

Digital Payment Market Key Players

1. Total System Services, Inc.

2. Wirecard AG

3. Novetti Group Limited

4. PayPal Holdings Inc.

5. ACI Worldwide Inc.

6. Adyen N.V.

7. Aurus

8. Aliant Payments

9. Alipay

10. Apple Pay

11. Dwolla

12. FattMerchant

13. FIS

14. Fiserv

15. Global Payments

16. Intuit

17. JPMorgan Chase

18. Mastercard

19. PayPal

20. Paysafe

21. PayTrace

22. PayU

23. Spreedly

24. Square

25. Stripe

For any Queries Linked with the Report, Ask an Analyst@ : https://www.maximizemarketresearch.com/inquiry-before-buying/16835

Table Of Content :

1. Global Digital Payment Market: Research Methodology

2. Global Digital Payment Market: Executive Summary

2.1 Market Overview and Definitions

2.1.1. Introduction to Global Digital Payment Market

2.2. Summary

2.1.1. Key Findings

2.1.2. Recommendations for Investors

2.1.3. Recommendations for Market Leaders

2.1.4. Recommendations for New Market Entry

3. Global Digital Payment Market: Competitive Analysis

3.1 MMR Competition Matrix

3.1.1. Market Structure by region

3.1.2. Competitive Benchmarking of Key Players

3.2 Consolidation in the Market

3.2.1 M&A by region

3.3 Key Developments by Companies

3.4 Market Drivers

3.5 Market Restraints

3.6 Market Opportunities

3.7 Market Challenges

3.8 Market Dynamics

3.9 PORTERS Five Forces Analysis

3.10 PESTLE

3.11 Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• The Middle East and Africa

• South America

3.12 COVID-19 Impact

Key questions answered in the Digital Payment Market are:

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Digital Payment Market?

- What major challenges could the Digital Payment Market face in the future?

- What segments are covered in the Digital Payment Market?

- Who are the leading companies and what are their portfolios in Digital Payment Market?

- What segments are covered in the Digital Payment Market?

- Who are the key players in the Digital Payment market?

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report @ : https://www.maximizemarketresearch.com/request-customization/16835

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2021)

- Past Pricing and price curve by region (2018 to 2021)

- Market Size, Share, Size & Forecast by different segment | 2023−2029

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

+1 800 507 4489 +91 9607365656

sales@maximizemarketresearch.com

Social Links: