Numerous scientific and engineering applications employ the potent nanofabrication and imaging method known as the focused ion beam (FIB). In order to selectively remove material from a sample or precisely deposit material onto a surface, it uses a narrowly focused stream of ions, often gallium ions. The main benefit of FIB is its capacity to carry out extremely localized operations on a nanoscale scale, which makes it crucial in industries like microelectronics, materials science, and biological research. An ion source, an ion column, a scanning system, and detectors make up FIB systems. In addition to material removal and deposition, FIB is widely used for imaging and cutting samples into cross sections for examination.

FOCUSED ION BEAM MARKET: REPORT SCOPE & SEGMENTATION

| Report Attribute | Details |

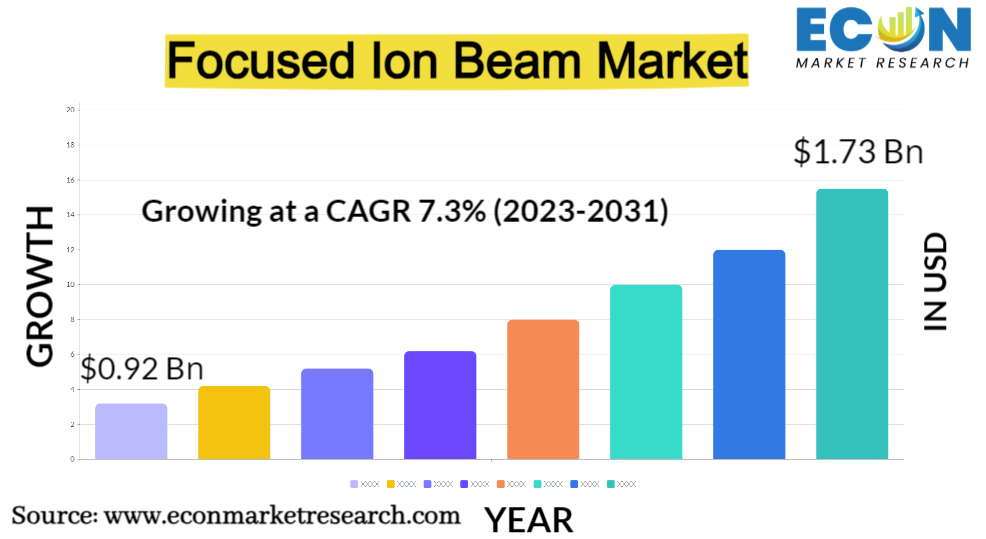

| Estimated Market Value (2022) | 0.92 Bn |

| Projected Market Value (2031) | 1.73 Bn |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Ion Source, By Application, By Vertical, & Region |

| Segments Covered | By Ion Source, By Application, By Vertical, & Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Global Focused Ion Beam Market Dynamics

The need for FIB systems is fueled by the growing need for miniaturization and accurate production across a range of sectors, including semiconductor, electronics, and materials science. A significant motivator is FIB's capacity for high precision and resolution nanoscale operations. Improvements in FIB technology, such as enhanced ion sources, scanning apparatus, and detectors, increase the systems' functionality and effectiveness, drawing in additional users. Furthermore, the rising uses of FIB in industries including materials characterization, failure analysis, and biological research present fresh prospects for market expansion.

Global Focused Ion Beam Market Drivers

- Advancements in Semiconductor Manufacturing

FIB technology plays a crucial role in the semiconductor industry for tasks such as failure analysis, editing integrated circuits, and circuit modification. With the increasing demand for smaller and more powerful electronic devices, the need for precise and accurate fabrication and analysis techniques offered by FIB systems is growing.

- Growing Demand for 3D Imaging and Analysis

Restraints:

- High Cost of FIB Systems

Focused Ion Beam systems are sophisticated and expensive instruments, limiting their affordability for small and medium-sized enterprises. The substantial initial investment and maintenance costs can deter potential customers from adopting this technology.

- Competition from Alternative Technologies

Opportunities:

- Integration with Other Technologies

Integration of FIB systems with other analytical tools, such as scanning electron microscopes (SEM) and transmission electron microscopes (TEM), can enhance the overall capabilities and functionality. This integration opens up possibilities for new applications and attracts potential customers from multiple industries.

- Emerging Applications in Life Sciences

Segment Overview

By Ion Source

Based on ion source, the global focused ion beam market is divided into Ga+ liquid metal, gas field, and plasma. The Ga+ liquid metal dominates the market with the largest revenue share of around 47.2% in 2022. Ga+ liquid metal ion sources provide various advantages over a gas field and plasma sources, including a longer operating lifespan, which reduces the need for frequent replacements and downtime. They have increased brightness, which results in better image resolution and material manipulation precision. Ga+ liquid metal sources also provide improved ion beam control, enabling for more precise and targeted material removal or deposition.

By Vertical

Based on vertical, the global focused ion beam market is divided into electronics & semiconductors, industrial science, bioscience, and material science. The electronics & semiconductors dominate the market with the largest revenue share of around 33.5% in 2022. The growing need for smaller, quicker, and more powerful electronic gadgets demands new production and analytical procedures. FIB technology has extraordinary capabilities for precise material manipulation, imaging, and failure analysis, making it important in the electronics and semiconductor industries.

By Application

Based on application, the global focused ion beam market is divided into failure analysis, nanofabrication, device modification, circuit edit, and counterfeit detection. The failure analysis category is anticipated to grow at a higher CAGR of 6.8% during the forecast period. Because of the rising complexity and miniaturization of electronic equipment, the demand for failure analysis methodologies is expected to expand significantly. Failure analysis is critical in finding and correcting problems in electronic components and systems. Furthermore, the growing semiconductor and electronics sectors, as well as the increasing use of FIB systems in R&D, help to the expansion of the failure analysis market.

Global Focused Ion Beam Market Overview by Region

The global focused ion beam market is divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the frontrunner with the largest revenue share, accounting for approximately 40.6% of the global market in 2022. In North America, numerous prominent firms operating in the semiconductor, electronics, and materials science industries extensively utilize focused ion beam (FIB) technology. The region's strong emphasis on technological advancements and innovation fosters a high demand for FIB systems. Additionally, the presence of well-established research institutes, universities, and government programs dedicated to nanotechnology research and development contributes to the expansion of the market.

Global Focused Ion Beam Market Competitive Landscape

In the global focused ion beam market, a few major players hold significant market dominance and have established a strong regional presence. These leading companies are committed to ongoing research and development efforts and actively engage in strategic growth initiatives such as product creation, product launches, joint ventures, and partnerships. Through these strategies, these companies aim to enhance their market position, expand their customer base, and capture a significant share of the market.

Some of the prominent players in the global focused ion beam market include Thermo Fisher Scientific Inc., ZEISS International, Tescan Orsay Holding, A.S., Hitachi, Ltd., JEOL Ltd., Eurofins Scientific, A&D Company, Limited, Veeco Instruments Inc., Raith GmbH, and various other key players.

Global Focused Ion Beam Market Recent Developments

In August 2022, Thermo Fisher Scientific Inc. has unveiled the Arctis Cryo-Plasma Focused Ion Beam (Cryo-PFIB), a cutting-edge microscope that incorporates cryo-electron tomography (cryo-ET) research. This innovative system provides integrated and automated capabilities, allowing researchers to improve their cryo-ET study.

Scope of the Global Focused Ion Beam Market Report

Focused Ion Beam Market Report Segmentation

| ATTRIBUTE | DETAILS |

| By Ion Source |

|

| By Application |

|

| By Vertical |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

Objectives of the Study

The objectives of the study are summarized in 5 stages. They are as mentioned below:

- Global Focused Ion Beam Market Size and Forecast:

To identify and estimate the market size for the global focused ion beam market segmented by ion source, by application, by vertical, region and by value (in U.S. dollars). Also, to understand the consumption/ demand created by consumers of Focused Ion Beam between 2019 and 2031.

- Market Landscape and Trends:

To identify and infer the drivers, restraints, opportunities, and challenges for the global focused ion beam market

- Market Influencing Factors:

To find out the factors which are affecting the sales of focused ion beam among consumers

- Impact of COVID-19:

To identify and understand the various factors involved in the global focused ion beam market affected by the pandemic

- Company Profiling:

To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company's past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Intended Audience

- Focused Ion Beam Manufacturers

- Raw Material Suppliers

- Retailers, Wholesalers, and Distributors

- Governments, Associations, and Industrial Bodies

- Investors and Trade Experts