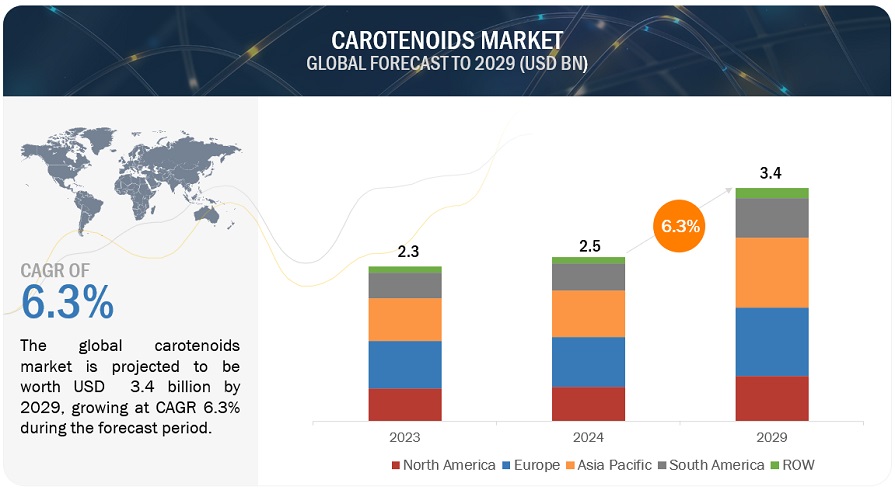

The global carotenoids market is estimated at USD 2.5 billion in 2024 and is projected to reach USD 3.4 billion by 2029, at a CAGR of 6.3% during the forecast period. The carotenoids market is experiencing significant growth due to several key factors driving demand. Firstly, there is a growing awareness and preference among consumers for natural and clean label products, particularly in the food, beverage, and cosmetics industries. Carotenoids, being natural pigments found in fruits, vegetables, and algae, are increasingly sought after as natural colorants and antioxidants, contributing to the market's expansion. Moreover, with rising health concerns and an increasing emphasis on preventive healthcare, the nutritional benefits of carotenoids, such as their role in supporting eye health and boosting the immune system, have garnered significant attention. Additionally, advancements in extraction and encapsulation technologies have enhanced the availability and efficacy of carotenoids in various applications, further fueling market growth. Furthermore, the expanding use of carotenoids in animal feed to improve animal health and enhance the color of poultry and fish products has contributed to the market's expansion.

- DSM (Netherlands)

- BASF SE (Germany)

- Cyanotech Corporation (US)

- Givaudan (Switzerland)

- ADM (US)

- NHU (China)

- Divi's Laboratories Limited (India)

- Allied Biotech Corporation (Taiwan)

- Lycored (US)

- Kemin Industries, Inc. (US)

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158421566

By source, the natural segment is expected to grow at the highest CAGR during the forecast period in terms of value.

Increasing consumer demand for natural and clean label products, fueled by growing health awareness and apprehensions regarding synthetic additives, is driving the preference for natural carotenoids. Regulatory agencies and health associations are endorsing the use of natural ingredients in food and supplements, amplifying the demand for natural carotenoids. Enhanced extraction techniques and intensified research and development endeavors have streamlined the production of natural carotenoids, making it more cost-effective and efficient. Consequently, these factors have propelled the natural segment to exhibit a superior CAGR in the carotenoids market in contrast to the synthetic segment.

By formulation, beadlet segment is estimated to grow at the highest CAGR during the forecast period.

Beadlet formulations present several advantages, including enhanced stability, improved bioavailability, and ease of integration into diverse food and beverage items. These qualities make them highly attractive to manufacturers seeking efficient methods to enrich their products with carotenoids. Recent advancements in beadlet formulation techniques have resulted in the creation of innovative and cost-effective production processes, stimulating market expansion. Furthermore, rising consumer awareness of carotenoids' health benefits, such as their antioxidant properties and support for eye health, has driven demand for products fortified with these compounds. Regulatory efforts advocating for natural ingredients in food and supplements have additionally propelled the beadlet segment, as beadlet formulations often utilize naturally sourced carotenoids.

By type, the astaxanthin segment is estimated to dominate the carotenoids market.

The dominance of the astaxanthin segment in the carotenoids market can be attributed to several factors. Astaxanthin is a potent antioxidant with various health benefits, including anti-inflammatory properties and support for cardiovascular health. Its unique molecular structure allows it to provide superior antioxidant activity compared to other carotenoids, making it highly desirable for consumers seeking natural supplements to improve overall health and well-being. Moreover, astaxanthin is commonly derived from natural sources such as microalgae and certain seafood, aligning with the growing consumer preference for natural and sustainable products. This natural sourcing contributes to the perceived purity and effectiveness of astaxanthin supplements, further driving its popularity in the market. Additionally, research highlighting astaxanthin's potential benefits for skin health, eye health, and athletic performance has fueled consumer interest and demand for products containing this carotenoid. Furthermore, advancements in extraction technologies and production processes have improved the availability and affordability of astaxanthin supplements, expanding its market reach.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=158421566

The Asia Pacific region is projected to have the fastest growth in terms of value.

The Asia Pacific region is experiencing a surge in consumer awareness about the health advantages of carotenoids, driving up demand for natural food additives and supplements. Rapid urbanization and the expansion of the middle class, particularly in countries like China, India, and Japan, are altering dietary preferences, with consumers increasingly seeking out products enriched with carotenoids for their antioxidant properties and potential health benefits. This shift has spurred significant growth in the food and beverage industry across the region, where manufacturers are integrating carotenoids into various products, including beverages, snacks, and dairy items, to cater to the growing demand for natural and healthful ingredients. Furthermore, supportive government regulations and initiatives promoting the adoption of natural ingredients in food and supplements are further propelling the expansion of the carotenoids market in the Asia Pacific region. Consequently, these combined factors are driving the highest CAGR observed in the carotenoids market in Asia Pacific compared to other regions.