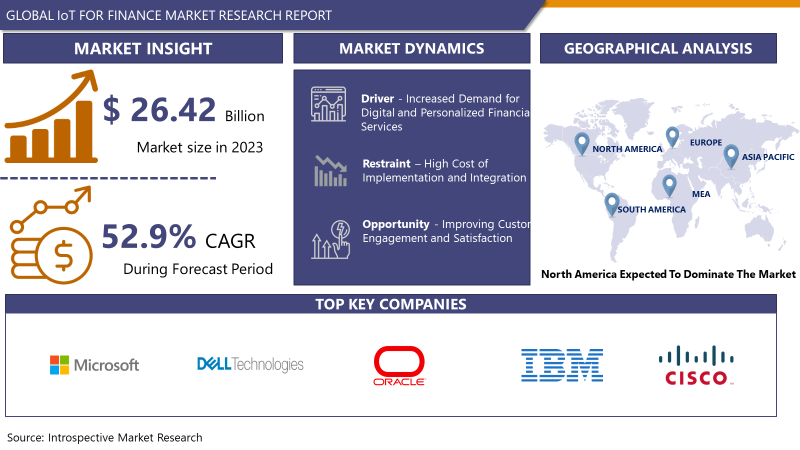

The IoT for Finance Market Size Was Valued at USD 1334.79 Million in 2023 and is Projected to Reach USD 11391.05 Million by 2032, Growing at a CAGR of 52.9 % From 2024-2032.

The IoT for finance market refers to the sector where Internet of Things (IoT) technologies are applied to various aspects of financial services and operations. This includes the integration of IoT devices, sensors, and data analytics to optimize processes, enhance customer experiences, improve risk management, and enable innovative financial products and services. In this market, financial institutions, fintech companies, and other stakeholders leverage IoT solutions to automate tasks, gather real-time data for analysis, monitor assets, and create personalized financial offerings tailored to individual needs.

Major Key Players Mentioned in this Premium Report

· IBM (U.S.)

· Cisco Systems (U.S.)

· Microsoft Corporation (U.S.)

· Oracle Corporation (U.S.)

· Intel Corporation (U.S.)

· Dell Technologies (U.S.)

· CGI Inc. (Canada)

· Hewlett Packard Enterprise (U.S.)

· SAP SE (Germany)

· Finastra (UK)

· Capgemini SE (France)

· Atos SE (France)

· Accenture plc (Ireland)

· Fujitsu Limited (Japan)

· Hitachi, Ltd. (Japan)

· Toshiba Corporation (Japan)

· NTT Data Corporation (Japan)

· Huawei Technologies Co., Ltd. (China)

· Infosys Limited (India)

· Tata Consultancy Services (India)

· Wipro Limited (India), and Other Major Players

Grab your free sample copy of this report now

https://introspectivemarketresearch.com/request/15068

What is IOT?

The Internet of Things (IoT) is a rapidly expanding network of interconnected devices equipped with embedded sensors, enabling the collection and exchange of data in real-time. In recent years, IoT has significantly bolstered the fintech industry, particularly in enhancing security and streamlining payment processing. Devices embedded with IoT technology serve as versatile mobile point-of-sale systems, exemplified by contactless cards. Moreover, IoT facilitates seamless data collection and sharing for finance teams, empowering them to make informed decisions regarding investments, insurance amounts, and customer risks. This technology also plays a crucial role in enhancing customer experiences by enabling personalized services. Furthermore, the data gathered by IoT devices is instrumental in detecting and mitigating fraud and cyber threats, thus fortifying the overall security landscape in finance.

Learn more about key segments shaping this market

By Solution Type

· Hardware

· Software

· Services

By Application

· Payments

· Fraud Detection

· Risk Management

· Asset Management

By End- User

· Banking

Geographic Coverage

· North America (U.S., Canada, Mexico)

· Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

· Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

· Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

· Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

· South America (Brazil, Argentina, Rest of SA)

The IoT for Finance Market report is quantitative and qualitative analysis by industry analysts, a compilation of information, inputs from industry experts, along with industry participants throughout the value chain. The analysis provides macroeconomic indicators an analysis of parent market trends, and factors together with market attractiveness according to sections. The report maps the impact of various market factors on market segments and geographies.

In case of any Queries please connect with our team, who will ensure that your requirements are met.

https://introspectivemarketresearch.com/inquiry/15068

Benefits of using IoT in finance

Utilizing IoT in finance offers a multitude of benefits, enhancing various facets of operations and decision-making processes. Firstly, IoT facilitates the collection and analysis of data from diverse sources, thereby enabling faster and more informed decision-making. By harnessing IoT devices to gather and scrutinize client data, businesses gain valuable insights into customer needs, facilitating quicker responses and tailored solutions. Moreover, when integrated with advanced technologies like AI, machine learning, and robotic process automation (RPA), IoT empowers finance leaders to extract actionable intelligence from big data, optimizing resource allocation and driving strategic decision-making.

Furthermore, IoT streamlines finance and accounting (F&A) operations by automating collaborative processes across departments. Instead of manual coordination, IoT-enabled systems automate data collection and updates, seamlessly integrating information into cloud platforms in real-time. This automation saves significant time and effort previously expended on collating and managing data from disparate teams.

Additionally, IoT enhances operational efficiency by enabling real-time tracking of employee and business performance. Wearable IoT devices monitor team productivity and promptly alert managers to any deviations from expected norms. Moreover, IoT devices provide continuous monitoring of operational assets such as ATMs and customer kiosks, ensuring optimal functionality and minimizing downtime. Overall, the integration of IoT technologies in finance drives efficiency, agility, and responsiveness across the organizational spectrum.

https://introspectivemarketresearch.com/checkout/?user=1&_sid=15068

Use cases of IoT in Finance

IoT presents numerous use cases across various aspects of the finance industry, revolutionizing traditional processes and enhancing customer experiences. Here are some notable examples:

· Asset Tracking and Management: IoT sensors can be deployed to track and manage physical assets such as vehicles, equipment, and inventory. This real-time tracking ensures better asset utilization, reduces the risk of theft or loss, and enables more accurate financial reporting.

· Payment Processing and Point-of-Sale (POS) Systems: IoT-enabled devices like contactless payment terminals and mobile card readers streamline payment processing for both businesses and consumers. These devices offer convenience, speed, and security, enhancing the overall payment experience.

· Risk Management and Compliance: IoT devices can collect and analyze data to assess and mitigate various risks faced by financial institutions, including fraud, cybersecurity threats, and regulatory compliance. For example, sensors can monitor environmental conditions in data centers to ensure compliance with regulatory requirements.

· Customer Insights and Personalization: By gathering data from IoT devices such as wearables and smart home devices, financial institutions can gain valuable insights into customer behavior and preferences. This data can be used to personalize product offerings, improve customer service, and drive customer engagement.

· Insurance Telematics: In the insurance industry, IoT-enabled telematics devices installed in vehicles can collect data on driving behavior, such as speed, acceleration, and braking patterns. Insurers can use this data to assess risk more accurately, customize insurance premiums based on individual driving habits, and promote safer driving practices.

· Smart ATMs and Branches: IoT technology enhances the functionality of ATMs and bank branches by enabling remote monitoring, predictive maintenance, and personalized services. For example, smart ATMs equipped with sensors can detect issues in real-time and automatically schedule maintenance, reducing downtime and improving operational efficiency.

· Fraud Detection and Prevention: IoT devices can play a crucial role in detecting and preventing fraud in financial transactions. By analyzing patterns and anomalies in data collected from various sources, including IoT sensors and devices, financial institutions can identify suspicious activities and take proactive measures to mitigate fraud risks.

These use cases demonstrate the diverse applications of IoT in finance, offering opportunities for improved efficiency, enhanced customer experiences, and better risk management practices.

About Us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Get in Touch with Us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA