The latest report by IMARC, titled "Germanium Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data" delivers a comprehensive analysis of germanium price prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Germanium Price Prices December 2023:

- USA: 1,454,581USD/MT

- China: 1,391,182 USD/MT

- Germany: 1,429,445 USD/MT

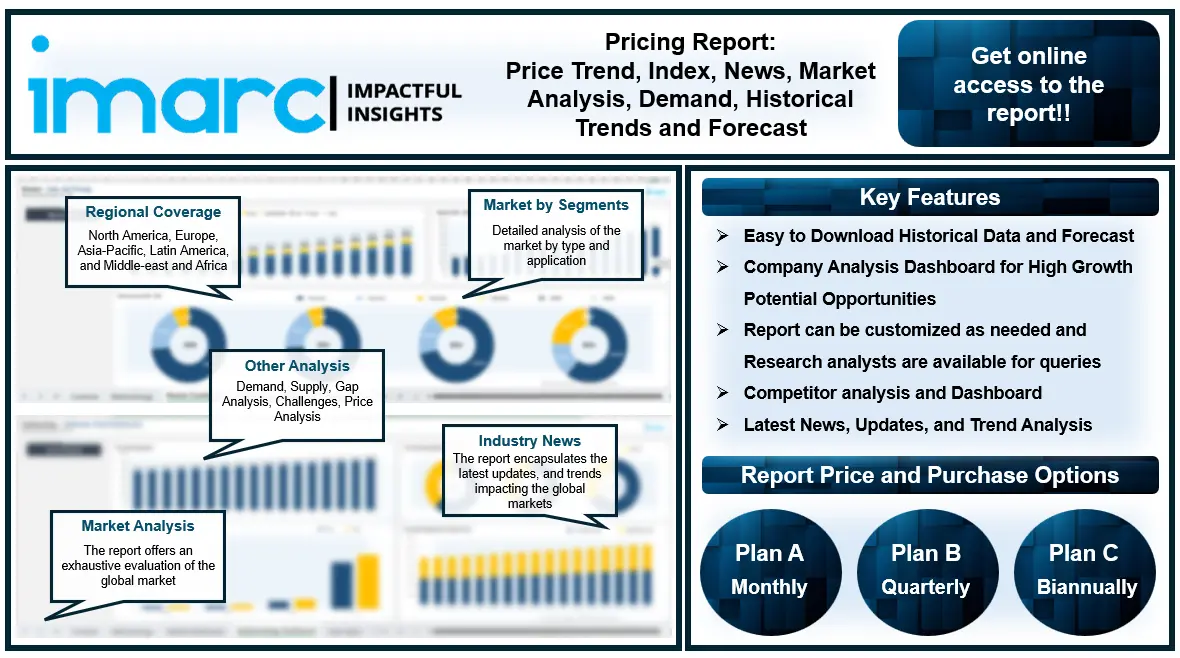

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting Germanium Price price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/germanium-pricing-report/requestsample

Germanium Price Price Trend- Q4 2023

Germanium’s critical role in the telecommunications industry as a component in fiber optic systems and infrared optics is driving its demand. Germanium's ability to enable clear, high-speed data transmission makes it indispensable in an era where digital communication and connectivity are ever-expanding. This demand is further bolstered by the increasing deployment of 5G technology, requiring advanced infrastructure that leverages germanium's properties for efficient data transmission. Additionally, germanium's application in the semiconductor industry is significantly contributing to its market growth. Its use in high-efficiency solar cells, particularly for space applications, and as a substrate material in the production of transistors and integrated circuits, underscores its importance in the electronics and renewable energy sectors. The push towards renewable energy sources and the need for high-performance electronic devices sustain the demand for high-purity germanium. The defense sector also plays a crucial role in driving Germanium demand, given its use in thermal imaging and night-vision devices. The strategic importance of these technologies for national security ensures steady investment and development in germanium-based applications. Moreover, research and development efforts aimed at discovering new applications and improving existing technologies involving germanium contribute to the metal's market growth. These innovations promise to open up new avenues for its application, further expanding its market potential. The combination of critical industrial demand, technological advancements, and strategic importance positions Germanium for sustained market growth.

The global germanium market size reached US$ 311.2 Million in 2023. By 2032, IMARC Group expects the market to reach US$ 437.2 Million, at a projected CAGR of 3.90% during 2023-2032. In the last quarter of 2023, the Germanium market across North America, Asia-Pacific (APAC), and Europe exhibited unique dynamics influenced by a variety of factors, each contributing to the fluctuating prices of Germanium, particularly the 99.99% purity metal. In North America, market resilience was a notable factor, with the United States playing a crucial role in the price variations observed. The stability in demand, coupled with the absence of any significant disruptions in supply, such as plant shutdowns, ensured a steady flow of Germanium in the market. This stability was juxtaposed with a nuanced price shift of 3% from the previous quarter, highlighting the market's sensitivity to evolving conditions. Moreover, rigorous trend analyses pointed to intricate correlations between seasonal nuances and pricing dynamics, offering deep insights into the market's adaptability. The uptick in fresh market purchases underscored strong trading fundamentals within the region, culminating in a specific price point for Germanium Metal (99.99%) CFR San Diego by the quarter's end.

Conversely, the APAC region, with China at its epicenter, experienced a different set of market conditions that shaped its Germanium price trajectory. The slight moderation in market demand acted as a pivotal determinant, driving prices up by 3.2% compared to the preceding quarter. Like North America, APAC markets benefited from uninterrupted operations, thanks to the absence of plant shutdowns, which might have otherwise led to supply constraints. Detailed trend analysis within the APAC region revealed a bullish market scenario, characterized by significant price changes and a palpable increment in market purchasing activities amidst tightening product availability. This scenario was indicative of the market's bullishness, with the closing price of Germanium Metal (99.99%) FOB Shanghai reflecting the prevailing market conditions. In Europe, the Germanium market narrative was woven around resilience and consistency, with Germany taking the lead in regional market dynamics. The absence of plant shutdowns played a critical role in ensuring a robust supply chain, thereby fostering market stability. Noteworthy price fluctuations in Germany highlighted its significant impact on the European market. A granular examination of the market trends, including a 2% price adjustment from the previous quarter, revealed the market's capacity to adapt to shifting dynamics. This adaptive nature was further illustrated by the examination of pricing scenarios in different halves of the quarter, which shed light on the dynamic market conditions. The synthesis of these factors provided a comprehensive overview of the European Germanium market, ultimately leading to a specific closing price for Germanium Metal (99.99%) CIF Hamburg. Across all regions, the last quarter of 2023 for the Germanium market was characterized by a complex interplay of demand and supply, market resilience, and regional specificities, all of which contributed to the observed price fluctuations and market sentiments.

Browse Full Report: https://www.imarcgroup.com/germanium-pricing-report

Key Points Covered in the Germanium Price Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Germanium Price Prices

- Germanium Price Price Trend

- Germanium Price Demand & Supply

- Germanium Price Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Germanium Price Price Analysis

- Germanium Price Industry Drivers, Restraints, and Opportunities

- Germanium Price News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports By IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163