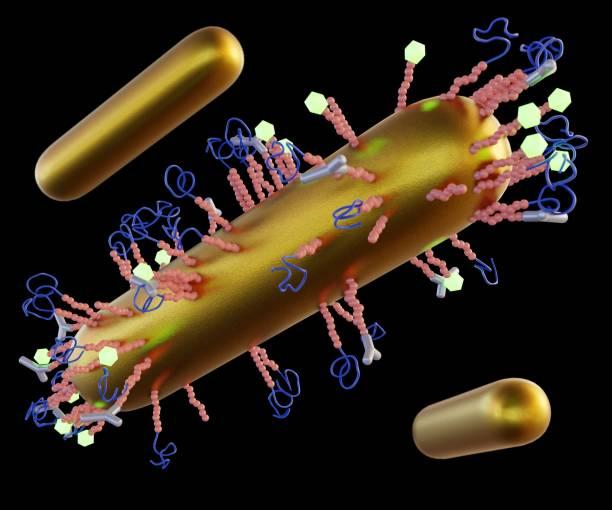

The antibody drug conjugates market consists of innovative targeted cancer therapies designed to deliver highly potent anti-cancer drugs specifically to tumor cells. These conjugates link monoclonal antibodies that bind to antigens present on certain cancer cell types to cytotoxic agents or chemotherapy drugs. By combining the unique targeting capabilities of monoclonal antibodies with the cancer-killing ability of cytotoxic drugs, antibody drug conjugates allow healthcare professionals to deliver higher doses of chemotherapy directly to the tumor while reducing systemic exposure and side effects. The growing prevalence of various cancer types and need for more effective therapies with fewer side effects is a major factor driving increased adoption of antibody drug conjugates.

The Global Antibody Drug Conjugates Market is estimated to be valued at US$ 5.38 Bn in 2024 and is expected to exhibit a CAGR of 14% over the forecast period 2023 to 2030.

Key Takeaways

Key players operating in the Antibody Drug Conjugates are AstraZeneca PLC, Daiichi Sankyo Company, Limited, Novasep, ADC Therapeutics SA, Alentis Therapeutics AG, F. Hoffmann-La Roche, Gilead Sciences, Inc., AbbVie Inc., Biosion USA, Inc., Astellas Pharma Inc., Duality Biologics (Suzhou) Co. Ltd., BioNTech SE, LaNova Medicines Ltd., Bliss Biopharmaceutical, Eisai Co., Ltd., ProfoundBio, Pfizer, Inc., ImmunoGen Inc., Mersana Therapeutics Inc., Sorrento Therapeutics Inc., Oxford BioTherapeutics Ltd, and Takeda Pharmaceutical Company Ltd. The rising prevalence of cancer types such as breast cancer, lung cancer, blood cancer, and others is expected to drive the demand for more effective targeted therapies like antibody drug conjugates. Technological advancements including site-specific conjugation methods, next-generation linker technologies, and highly potent payloads are further improving the efficacy and safety profiles of antibody drug conjugates.

Market Trends

The market is witnessing increasing research into antibody drug conjugates for solid tumors. While currently approved ADCs target hematological or liquid tumors, clinical research is ongoing into conjugates for solid tumors like breast cancer, lung cancer, gastric cancer and others which account for majority of newly diagnosed cancers. This trend presents a major commercial opportunity. The market is also witnessing growing adoption of cleavable linker technologies. Recent advances allow linkers to release drug payloads inside tumor cells while preventing premature release in circulation. This enhances safety and efficacy profiles of ADCs.

Market Opportunities

The market sees opportunities in developing ADCs for rare cancers with high unmet need. While major players focus on large prevalent cancer types, opportunities exist for targeted ADCs addressing orphan cancers. There is also opportunity to develop multi-specific ADCs combining tumor targeting via two or more antigens for improved efficacy against heterogeneous tumors.

Impact of COVID-19 on Antibody Drug Conjugates Market Growth

The COVID-19 pandemic has impacted the growth of the antibody drug conjugates market. During the initial phase of the pandemic, several clinical trials were halted or delayed due to concerns over patient safety and priority being given to COVID-19 research. This impacted the development of new antibody drug conjugates in the pipeline. Additionally, lockdowns and restrictions imposed to curb the spread of the virus led to disruptions in manufacturing and supply chain operations. This caused shortages of raw materials and key components required for manufacturing antibody drug conjugates. The commercial launches of some newly approved antibody drug conjugates in 2020 were also postponed or delayed.

However, with economies restarting operations and a better understanding of the virus emerging, the antibody drug conjugates market is recovering. Clinical trials have resumed with safety protocols in place. Companies are leveraging digital technologies to minimize disruptions in development activities. Supply chains are being diversified and local sourcing is being increased to reduce dependencies. The pandemic has also highlighted the need for effective cancer treatments. This is driving increased investment in development of novel antibody drug conjugates to expand the target patient pool. Several studies are also evaluating the efficacy of existing antibody drug conjugates for COVID-19 treatment. Hence, post pandemic the market is expected to witness faster growth on the back of new product approvals and robust pipeline.

Geographical Regions with Highest Value for Antibody Drug Conjugates Market

North America accounts for the largest share of the global antibody drug conjugates market in terms of value. This is attributed to rising incidence of cancer, strong presence of major pharmaceutical companies involved in drug development and commercialization, robust healthcare infrastructure and high reimbursement framework in the region, especially in the US. Extensive R&D efforts by academic institutes and biotech startups for developing novel ADCs are also fueling market growth.

Asia Pacific is projected to be the fastest growing regional market during the forecast period driven by increasing healthcare investments, growing cancer burden, rising disposable incomes and expanding access to newer treatment options in China and India. The low manufacturing and labor costs along with growing biosimilar industry have propelled the establishment of manufacturing facilities of multinational companies in Asia Pacific supporting regional market growth.

Fastest Growing Geographical Region for Antibody Drug Conjugates Market

Asia Pacific is poised to register the fastest growth in the global antibody drug conjugates market over 2023-2030. This is attributed to rapid economic development across various Asia Pacific countries resulting in rising healthcare expenditures. The growing geriatric population, combined with changing lifestyle disorders is augmenting the incidence of cancer. Additionally, expanding base of global pharmaceutical companies and medical technology providers in Asia Pacific is improving access to novel treatment solutions such as antibody drug conjugates. Initiatives by governments to strengthen healthcare infrastructure and boost local manufacturing are creating a favorable market environment. Rising disposable incomes are increasing the ability of patients to spend on high-cost specialty drugs like ADCs. The abovementioned factors are expected to fuel higher investments in clinical research and commercialization of new antibody drug conjugates in Asia Pacific.